The newly introduced TDS on crypto transfers will be in effect as of July 1 and the Central Board of Direct Taxes (CBDT) released detailed guidelines last week clarifying some of the doubts raised by the crypto investors and the people in general. Finance Minister Nirmala Sitharaman announced a 30 per cent tax rate and 1 per cent TDS for gains made from virtual assets and transfers in the Budget earlier this year.

In its circular, CBDT has clarified some of the pertinent questions. Since the crypto exchanges in India will have a critical role to play in this ecosystem, they have been preparing for the D Day and through their blogs are trying to educate and prepare the investors.

1. Who will deduct TDS while transferring crypto via an exchange?

As per the circular, according to section 194S of the Act, any person who is responsible for paying to any resident any sum by way of consideration for transfer of VDA is required to deduct tax. Thus, in a peer-to-peer (i.e. direct buyer to seller) transaction, the buyer (i.e person paying the consideration) is required to deduct tax under section 194S of the Act. However, if the transaction is taking place on or through an Exchange there is a possibility of tax deduction requirement under section 194S of the Act at multiple stages.

The Circular further clarifies, In this case, buyer would be crediting or making payment to the Exchange (directly or through a broker). The Exchange then would be required to credit or make payment to the owner of VDA being transferred, either directly or through a broker.

2. Will I be subject to TDS if my total trade value doesn’t exceed ₹10,000?

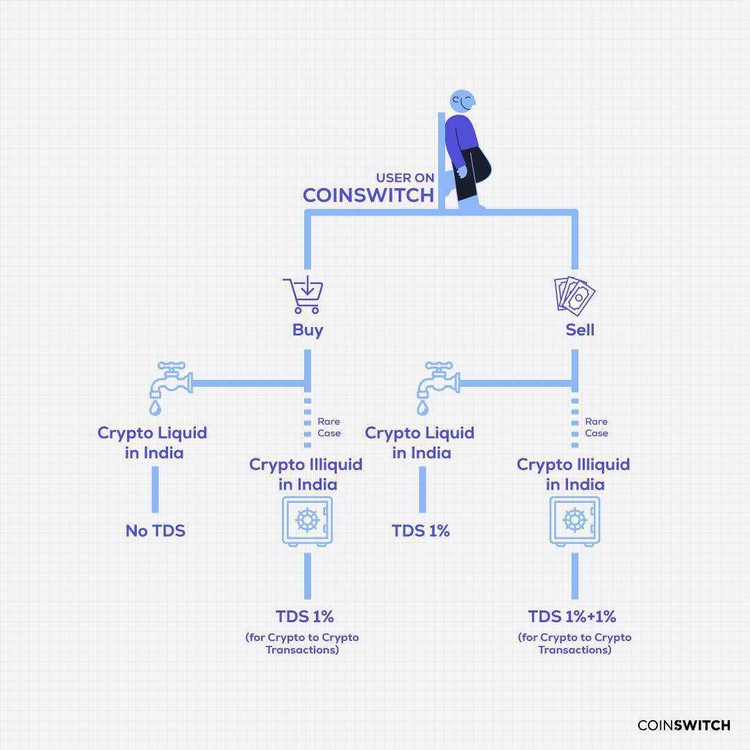

CoinSwitch in a blog educates ‘What is TDS, and How Does It Impact Your Crypto Transactions? While explaining the process, it clarifies that a transaction will not be subject to TDS if the total trade value doesn’t exceed ₹10,000 in the said financial year (2022-23). To ensure transparency, CoinSwitch will provide you with the following documentation:

- Transaction note/Tax invoice with the breakup of TDS and fees

- Quarterly Form 16A certificate for better tax management

3. Is the KYC process mandatory?

Yes, it is. In fact, CoinDCX, a leading Crypto Exchange in India, has mentioned this and has advised all users will have to mandatorily complete their KYC process on/or before July 1, 2022, in order to make any transaction.

TDS is the tax deducted at the source which is paid to the Government on behalf of the deductor by CoinDCX as a part of compliance with the new crypto taxation rules announced in the Union Budget 2022. This will be available as a credit against your tax liabilities at the end of the financial year.

In compliance to this, all users will have to mandatorily complete their KYC process on/or before July 1, 2022 in order to make any transaction (Buy/Sell) on CoinDCX Pro.

In a LinkedIn post, Sumit Gupta, CEO, CoinDCX, said that the exchange is ready to implement 1% TDS.

4. What will happen to the TDS deducted by the exchanges?

Wazir X has simplified the TDS for its users and has answered this question:

The TDS collected needs to be paid to the Income Tax Department in the form of INR. For this, any TDS collected in the form of Crypto has to be converted to INR. For ease of conversion and to reduce price slippage, in Crypto to Crypto transactions, the TDS for both sides would be deducted in the quote (or primary) Crypto asset. WazirX markets have 4 quote assets- INR, USDT, BTC, and WRX. For example, in the following markets: MATIC-BTC, ETH-BTC, and ADA-BTC, BTC is the quote Crypto asset, and hence the TDS of both the buyer and seller trading in these markets would be deducted in BTC.

Examples:

INR markets: 1 BTC traded for 100 INR. BTC seller receives 99 INR (after 1% TDS deduction). BTC buyer receives 1 BTC (no TDS deducted).

Crypto-Crypto markets: 1 BTC sold for 10 ETH. BTC seller receives 10 ETH by paying 1.01 BTC (after 1% TDS addition). BTC buyer receives 0.99 BTC (after 1% TDS deduction).

Earlier this year, Nischal Shetty, Founder and CEO at WazirX, had pointed out the consequences of 1% TDS on investors and traders.

5. How TDS will be calculated for various order types?

CoinDCX helps with a very detailed answer as below:

| Insta Spot Buy – No TDS is applicable (App)Quickbuy Insta Buy – No TDS is applicable (Web) |

| Insta Spot Sell – 1% TDS is applicable (App) Quickbuy Insta Sell – 1% TDS is applicable (Web)For example; 1% TDS to be deducted on the overall transaction value. If the sell value is INR 1500, we need to deduct (1%of 1500) as TDS from the user and the user will get (1500-x%of 1500 – fees) in his account. So, we will deduct 1*1500/100 ie INR 15 as TDS and if the fee is 0.3%, we will deduct 0.3*1500/100 ie INR 4.5 as fees, so the user will get back (1500-1*1500/100 – 4.5) = INR 1480.5 in his/her account. |

| Spot Buy – INR pairs – No TDS |

| Spot Sell – INR pairs – 1% TDS is applicable For example, 1% TDS will be deducted on overall transaction value. If the sell value is INR 1500, we will deduct 1% of 1500 as TDS from the user, and the user will get (1500 – 1% of 1500 – fees) in their account. So we will deduct 1*1500/100 ie, INR 15 as TDS and if fees are 0.3%, we will deduct 0.3*1500/100 ie, INR 4.5 as fees, so the user will get back (1500-1*1500/100-4.5) = INR 1480.5 in their account. |

| Spot Buy – Non-INR pairs (C2C) – 1% TDS For example: 1% TDS will be deducted on the overall transaction value. We will do the TDS deduction on the base token. Let’s say the user transacts in BTC-USDT and buys 1 BTC at a price of 40,000 USDT. We will ask the user for 1% TDS in USDT ie 1/100*40000 = 400 USDT and 0.3% in fees (whatever the fees is) ie 0.3/100*40000 = 120 USDT, ie, a total of 40520 USDT for this transaction. Both fees and TDS are applied on the value of the transaction. |

| Spot Sell – Non-INR pairs (C2C) – 1% TDS For example 1% TDS will be deducted on overall transaction value (the deduction will be on the base token). Let’s say, the user transacts in BTC-USDT and sells 1 BTC at a price of 40,000 USDT, we will give back to the user after deducting 1% TDS in USDT ie, 1/100*40000 = 400 USDT – a total of 39600 USDT for this transaction. |

| Margin Long – 1% TDS on total value of position for both opening and closing orders For example: 1% TDS will be deducted on overall actual transaction value including leverage. So if a user is buying 1 BTC at a price of 40,000 USDT at 10x leverage, the margin required would be 4000 USDT, but the actual transaction value would be 40,000 USDT; hence, in this case, we will apply TDS on the entire 40,000 USDT. Let’s say the user transacts in BTC-USDT and takes a leverage position of 1 BTC at a price of 40,000 USDT, we will then ask the user for 1% TDS in USDT ie, 1/100*40000 = 400 USDT and 0.2% in fees (whatever the fees is) ie, 0.2/100*40000 = 120 USDT, ie, a total of (520 USDT + margin + TDS required for selling) required for this transaction. Both fees and TDS are applied to the value of the transaction. TDS required for closing position needs to be taken in the form of extra margin. |

| Margin Short – 1% TDS on the total value of position for both opening and closing orders Same as Margin Long. The user must maintain an extra margin corresponding to the TDS value. |

| Lend – No TDS is applicable |

| Earn – No TDS is applicable |

| Futures – No TDS is applicable |

Note: 0.2% fee is indicative and is subject to changes. Please use this only for reference.

With all the criticism from the crypto community for 30% tax and 1% TDS, finally, the country is all set to roll out from July 1.